As an early adopter and long-time champion of WordPress, I’ve been keenly watching from the sidelines as the legal dispute between WP Engine and Automattic has begun to unfold. Even prior to the case being brought about by WP Engine, those of us WordPress enthusiasts that keep up to date with industry happenings via Facebook groups, YouTubers, podcasts and obscure mailing lists were all too keenly aware of Matt Mullenweg’s (Founder of WordPress and CEO of Automattic) discontent.

Ostensibly stemming from his strong belief that his business is owed its pound of flesh, Matt’s disillusionment with the hosting company is clear and his determination to recoup financial loses resulting from trademark infringements, no matter the wider repercussions for WordPress, it’s users and the wider open source community, has at best sent ‘mildly concerned’ ripples through the FinTech sector, and at worst, completely called into question WordPress’ viability for FinTech businesses.

Understanding wider UK sentiment toward the Automattic/WP Engine dispute

Takeaways

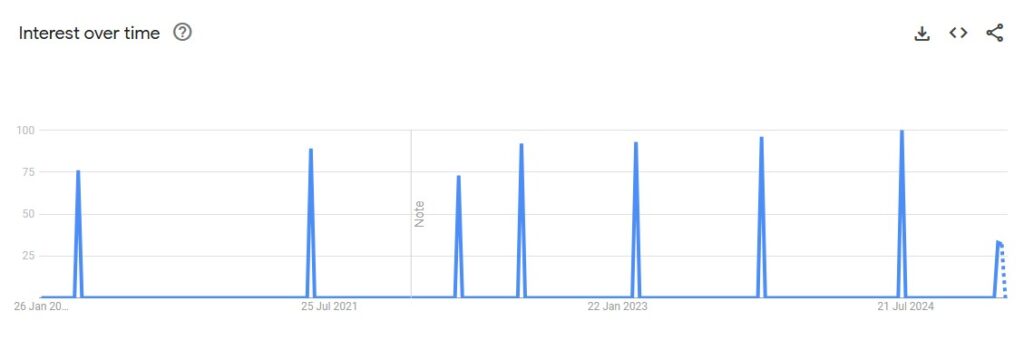

The public dispute between Matt Mullenweg, co-founder of WordPress, and WP Engine has significantly influenced the search trends for “WordPress Alternatives” Here’s how:

-

- Initial Dispute: In mid-September 2024, Matt Mullenweg published a blog post criticizing WP Engine for not contributing enough to the open-source WordPress project and for allegedly misleading customers by using the “WP” brand. This sparked a heated exchange between the two parties1.

-

- Legal Battle: Following Mullenweg’s comments, WP Engine sent a cease-and-desist letter, and Automattic (Mullenweg’s company) responded with its own legal actions. This legal battle drew widespread attention and media coverage, leading to increased public interest in alternatives to WordPress1.

-

- Community Reaction: The dispute also caused a rift within the WordPress community, with some members calling for governance changes and expressing concerns about Mullenweg’s control over the project. This internal conflict further fueled the search for alternative platforms3.

-

- Periodic Peaks: The periodic spikes in search interest, as shown in the Google Trends chart, likely correspond to key events in the dispute, such as major announcements, legal filings, and public statements from both parties1. Each new development reignited public curiosity about other website building options.

In summary, the ongoing controversy and legal battle between Mullenweg and WP Engine have kept the topic in the public eye, leading to periodic surges in searches for alternatives to WordPress. This cyclical pattern of interest reflects the dynamic nature of the dispute and its impact on the WordPress ecosystem.

With all of that in mind, I’ve decided to take stock by assessing the current FinTech landscape, digging into the current CMS’s of choice for some of the leading FinTech businesses in the UK.

The Technology Behind the UK’s Leading FinTech Websites

The companies included within this dataset include the top 50 Leading UK FinTech’s as tracked by founder and start-up community f6s.com.

Companies

Top 50 Leading UK FinTech’s

- Wise

- Finbourne

- monese

- Zopa

- Monzo

- Elliptic

- Form3

- TrueLayer

- Revolut

- TransferGo

- Hokodo

- moneybox

- Go Cardless

- Thought Machine

- codat

- Lenderwize

- Solidatus

- OutThink

- Freetrade

- Navro

- Shapeshift

- Tide

- Soldo

- Mishi Pay

- Fintuity

- Symmetric

- WleePay

- previse

- moneyfarm

- PrimaryBid

- Delio

- payable

- Credit Benchmark

- GEMBA

- VCRED

- Ref Finance

- Red Matter Capitial

- Token

- PremFina

- RIVA Markets

- SDG Assessment

- Klink Finance

- FinCrime Dynamics

- Credit Enable

- 9fin

- Billion

- Bud

- Wallid

- crowdinvest

- Meniga

Takeaways

-

- This data gives us a snapshot in time rather than a full picture of what’s to come. And, while WordPress appears to still hold the ‘top spot’ when is comes to CMS choice for FinTech’s, the answer to how long it will remain top of the table remains unclear. For example, how many of the current users of WordPress are considering migrating to other platforms?

-

- Other approaches to website design, development and deployment such as static site generation and newer platforms such as Webflow appear to have a relatively strong foothold.

-

- Sometimes it’s what’s in the data that’s as intriguing as what is. The notable absence of Drupal, Craft CMS and other WordPress competitors frankly surprised me.

What could this all mean for the future?

Despite the very public and potentially damaging legal dispute between WP Engine and Automattic, WordPress continues to hold a strong foothold as the preferred CMS for many of the UK’s leading FinTech businesses.

The adaptability of the platform, combined with its unrivalled community of independent developers, suggests that it will remain a viable choice for at least the near-term. The spikes in search interest for WordPress alternatives reflect a healthy curiosity and are somewhat to be expected as a result of wide media coverage of the ongoing legal cases. It does not however necessarily signal a mass exodus. Instead, it underlines the dynamic nature of the industry and the importance of staying informed about new developments. In my experience, WordPress has consistently evolved to meet the needs of its users, and with continued innovation and improvement, it could be well-positioned to retain the trust and preference of the FinTech sector. With that said, I’ll be watching closely over the next several months as the story develops.